The current growth of the U.S. economy, particularly in terms of GDP, is being closely observed.

Using the GDPNow model from the Federal Reserve Bank of Atlanta, the estimated real GDP growth for the third quarter of 2025 stands at about 4.0% annually, which is slightly higher than the 3.9% forecast a week earlier.

atlantafed.org

Earlier forecasts from the Conference Board indicate that although growth is slowing, it is not declining sharply.

They predict a moderate growth trajectory for late 2025 and into 2026.

The Conference Board

+1

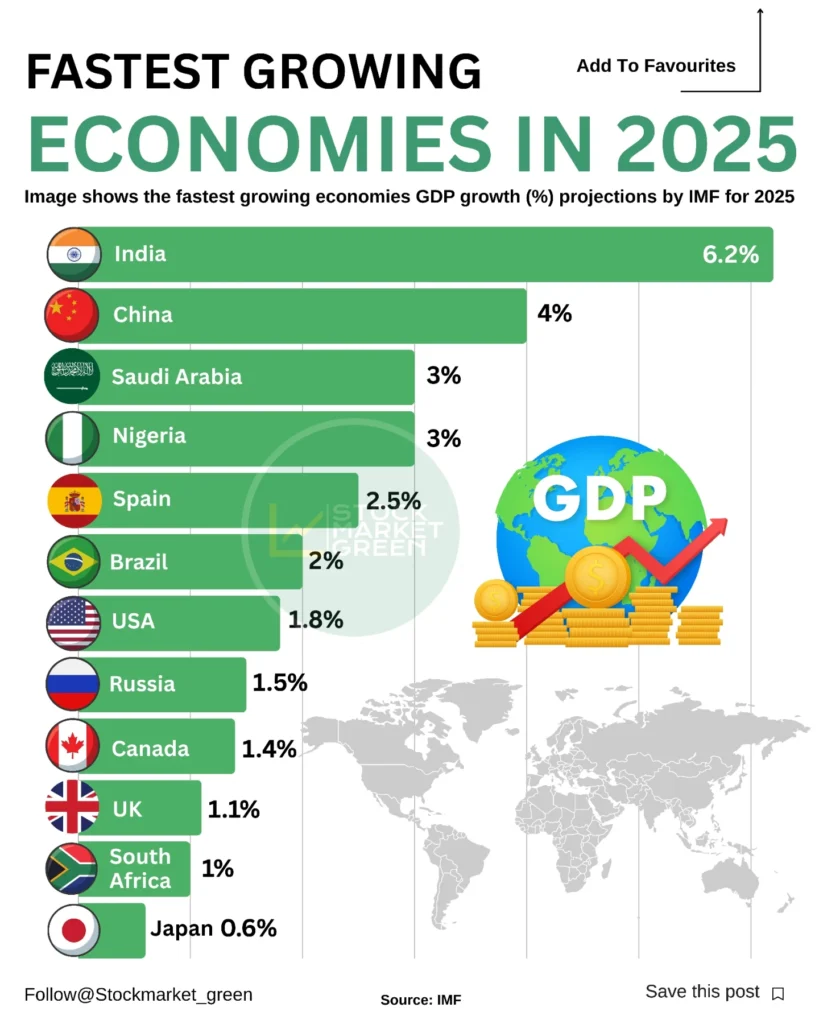

Recently, the International Monetary Fund (IMF) has increased its forecast for U.S. economic growth for 2025 to about 2.0% and for 2026 to about 2.1%.

AP News

+1

This level of growth is not high, but it is still positive in the current environment, showing that the economy is still expanding.

Monetary policy and currency trends

The U.S. dollar has been gradually rising, as financial markets now anticipate that the Federal Reserve may not cut interest rates as quickly as previously expected.

Reuters

Comments from the Fed, such as those from Governor Lisa D. Cook, highlight that while inflation is decreasing, there are still risks, and monetary policy will continue to be based on data.

Federal Reserve

Technological and structural supports

One notable development is that investment in artificial intelligence and technology is being recognized by some as helping to offset challenges from trade and tariffs.

According to IMF commentary, this investment serves as a kind of cushion for the economy.

Financial Times

+1

Consumer confidence has shown a slight increase since summer, which is positive for growth driven by consumer spending.

S&P Global

Strain on lower-income households and uneven growth

A recent article pointed out that lower-income consumers are facing increasing pressure due to higher costs in areas like healthcare and housing, slower wage increases, and fewer savings than seen in earlier stages of the economic expansion.

Reuters

This situation raises concerns about a K-shaped recovery, where some parts of the economy—such as higher-income groups, technology, and investment sectors—perform well, while others, like lower-income and vulnerable workers, struggle.

If darken-income households reduce their spending, it can lead to a broader slowdown in consumption growth.

Manufacturing and business confidence

Some key industrial and manufacturing data show signs of cooling.

For example, data from the Purchasing Managers’ Index (PMI) suggest slow growth or near-stagflation in certain sectors.

S&P Global

Uncertainty about tariffs, trade policies, and global supply chain issues continues to hinder the economy.

For example, one report stated that higher tariffs and related uncertainty are major obstacles.

The Conference Board

Policy and fiscal risks

The ongoing federal government shutdown is creating data gaps and delays in reports, and could disrupt government services.

This complicates forecasting and business planning.

Wikipedia

+1

Although the debt ceiling and borrowing needs are not currently in the headlines, they remain a background risk.

Consumer spending – As much of U.S. economic growth depends on consumer behavior, it is important to observe how lower-income and less-saved consumers respond to cost pressures.<

br>

Business investment and manufacturing – If investment slows significantly or manufacturing enters a contraction, it could raise broader concerns.<

br>

Monetary policy shift – Markets are watching closely for when the Fed might cut interest rates.

However, given inflation and uncertainty, rate cuts may not happen soon.<br>

Fiscal and government risks – The shutdown could delay the release of key economic data like jobs figures and GDP components, and might reduce growth if it continues.<

br>

External and trade risks – Tariffs, supply chain disruptions, and slowing global demand can affect U.S. exports and business confidence.<

br>

🔍 Focusing on why lower-income pressure matters

Here’s why the situation of lower-income consumers is particularly significant:

Many higher-income households have built up savings from the pandemic or have more flexibility to handle cost increases, while lower-income households typically have less financial cushion.

r>

When lower-income households cut back on spending, the impact goes beyond their own consumption—it affects local services, retail, and hospitality, which can lead to broader employment and income effects.

r>

Some data show that while official unemployment remains low, job gains are slowing, meaning fewer new jobs are available for those who have lost jobs or are marginally attached to the labor force. <

br>The Conference Board

A reduction in spending by this group can have a multiplied effect. E

ach dollar lost can lead to less income elsewhere, reducing growth more than the headline figures suggest.r>

🧭 The impact of the shutdown

The ongoing federal government shutdown is causing significant disruption:

Many federal services are on furlough or operating at reduced capacity, affecting economic activity related to government employees and contractors.

>

More importantly, key economic reports such as jobs data and industrial production are delayed or incomplete, increasing uncertainty. Th

is uncertainty can cause businesses and investors to take a more cautious approach. r>Wikipedia

+1

If the shutdown continues, some forecasts suggest it could reduce GDP growth in the fourth quarter by up to 1% (depending on how long it lasts).

>

📅 What to watch in the coming weeks and months

The jobs report (non-farm payrolls), unemployment rate, and wage growth—particularly whether wage gains continue for lower-income groups.

Consumer spending and retail sales data—will we see a slowdown or a pullback from weaker groups?

Manufacturing PMI and ISM data—will we see contraction or just a slowdown?

Fed comments and upcoming meeting minutes—when will they signal a change in the interest rate path?

Fiscal developments: resolution (or not) of the government shutdown, and any significant spending or tax policy changes.

Corporate earnings, especially for companies that rely on lower-income consumer spending (retail, services) and for sectors that depend heavily on investment.

The U.S. economy is not in collapse, but it is facing multiple challenges. Grow

th remains positive, partly due to investment (especially in technology and AI) and consumer spending. However, risks are increasing: lower-income households are facing pressure, manufacturing and investment are showing signs of weakness, and there is growing uncertainty about fiscal and monetary policies. The key question is whether these risks will push the economy into a more serious slowdown or cause a broader reduction in growth.

<

br>If you would like, I can prepare a forecast scenario (base, optimistic, pessimistic) for the U.S. economy over the next 6 to 12 months, tailored for key sectors. Would that be helpful?